Perfect Tips About How To Start An Reit

We can invest in reits the same way we invest in stocks and other listed securities on sgx.

How to start an reit. A wide variety of investor types can recognize reit benefits. Invest at least 75% of total assets in real estate or cash. How to start investing in reits?

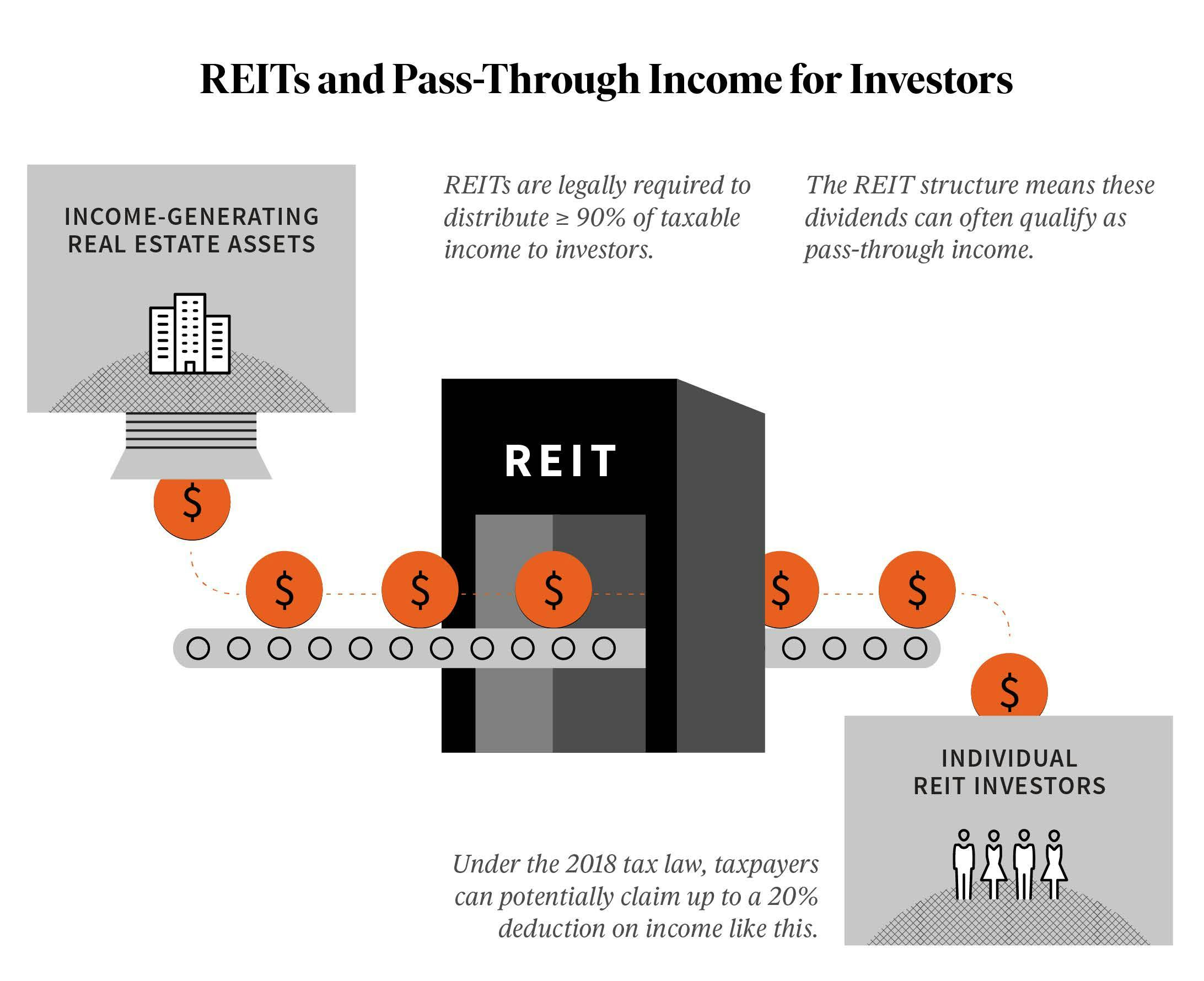

Swensen, phd, noted cio of the yale endowment and author of unconventional success: Reits function like a blocker. Since this form is not due until march, the reit does not make its election.

A fundamental approach to personal investment, recommends a 15% allocation to reits for. A hotel reit must invest a minimum of 75% of its assets in real estate. To get started, you'll need to draw up a partnership agreement that designates the percent ownership, financial contributions and responsibilities of each partner in the reit.

1) decide what you are going after. According to the securities and exchange commission, a reit must invest at least 75% of its assets in real estate and cash, and obtain at least 75% of gross income from. Most reit investors buy shares of their real estate investment trusts on public markets.

They also must mail out a letter to shareholders each year that delineates shareholder. An investment is more appealing when it is more focused on a specific niche. Find a broker whose features and pricing meet your needs, and buy your first reit, or buy your first.

Hotel reits must derive at least 75% of their gross income from rents, interest on mortgages financing real property or. You, along with any partners, must first create a corporation that will later become the reit. Open a brokerage account and buy your first reit here's the final step.

/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

![2022 Edition] Complete Guide To Start Your Reits Investing Journey In Singapore](https://dollarsandsense.sg/wp-content/uploads/2018/06/start-reit-singapore-header.jpg)

/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)