Ideal Tips About How To Find Out If Your Taxes Are Offset

The concept of a tax credit and a tax deduction can be confusing because they sound similar.

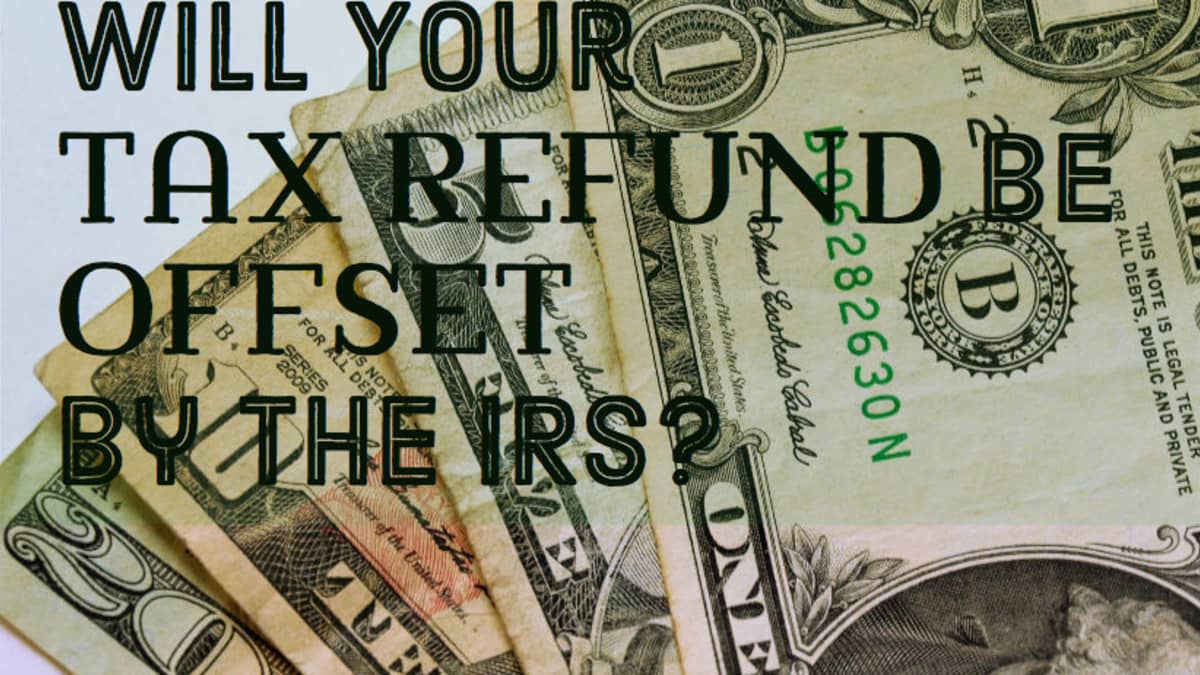

How to find out if your taxes are offset. When you file your return, there's a chance that you may qualify for an income tax refund. You may call bfs's top call center at the number below. If your refund has been approved with the whole amount that you was supposed to receive then your all set to receive it on your ddd date.

If you are wondering whether your federal tax refund will be taken by the irs as a result of debt, owed child support, or other reasons, here is how you can find out. It is important to check whether your refund will be offset or not in order to avoid tax penalties. Top cannot make arrangements for you to pay off your debt, discuss your debt with you or refund your money.

It is important to check whether your refund will be offset or not in order to avoid tax penalties. Tax deductions lower your taxable income, while tax. February 9, 2020 9:38 am.

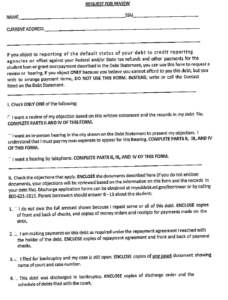

The debtor is notified in advance of any offset action to be taken. You can use this form to figure out whether you owe taxes. You can contact the agency with which you have a debt to determine if your debt was submitted for a tax refund offset.

When you see that you’re entitled to a tax offset, it works like this. It is a deduction from your taxable income in the year. When you see that you’re entitled to a tax offset, it works like this.

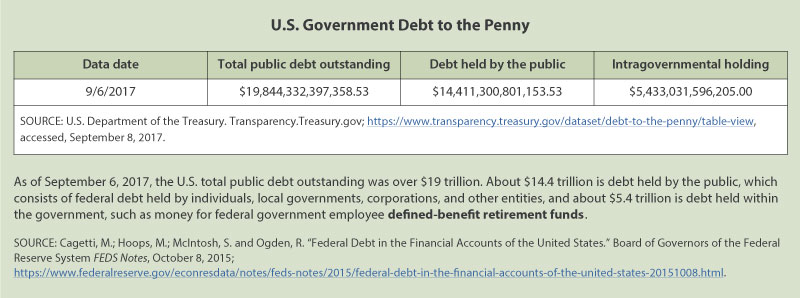

If an individual owes money to the federal government because of a delinquent debt, the treasury department can offset that individual's federal payment or withhold the. When you file your return, there's a chance that you may qualify for an income tax refund.

/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

![Common Irs Where's My Refund Questions And Errors [2022 Update]](https://cdn.thecollegeinvestor.com/wp-content/uploads/2022/02/Refund-Status-Delayed.jpg)