Formidable Tips About How To Buy Back Pension Years

My first year was contract and i did not contribute to the pension plan.

How to buy back pension years. You may buy back your prior service by surrendering your pension entitlement under the members of parliament pension plan. If you have previously taken a refund of imrf contributions or are eligible for other. For 2019/20, the new state pension is £168.60 per week or £8,767 per year.

This could be because you were: For those who do stand to benefit from buying back an extra year then the rewards are pretty good, but they do depend on when. With ten years in the system you would therefore get roughly £2,500 per year.

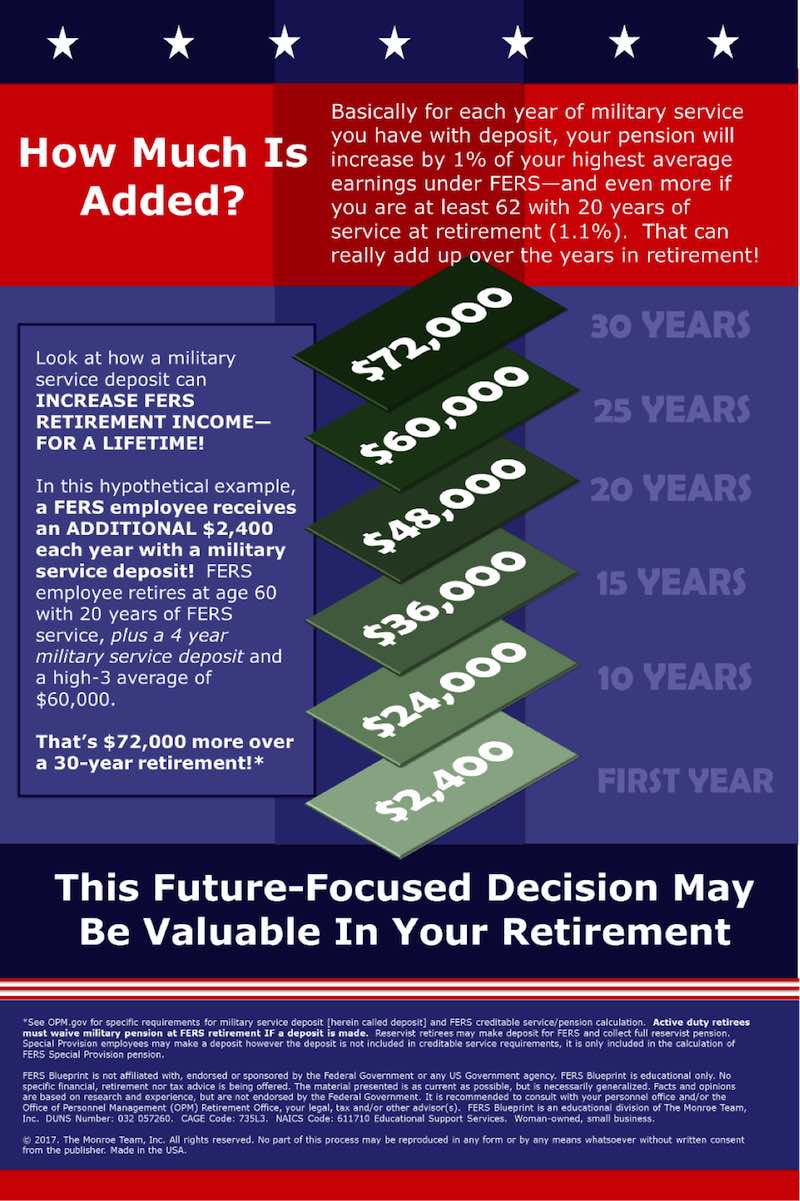

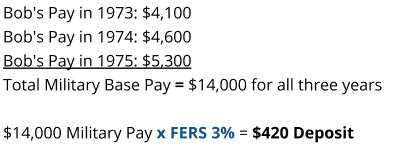

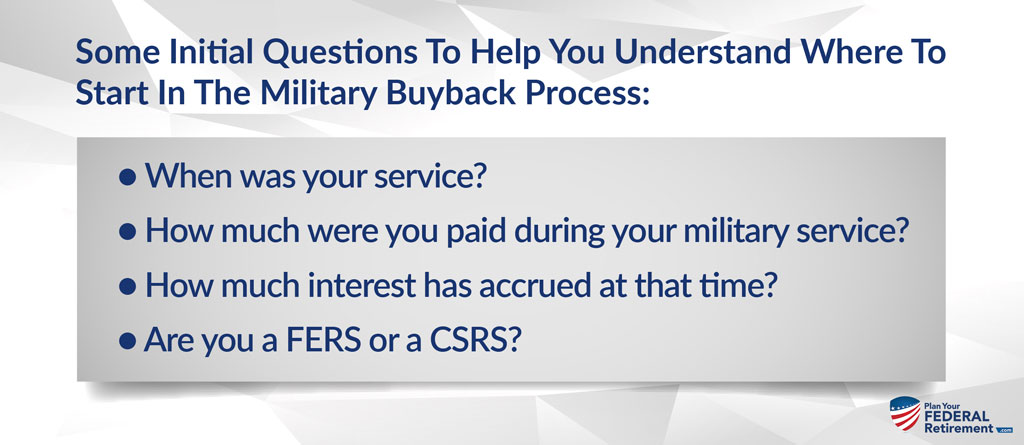

You can repay in a lump sum or installment payments if approved by your retirement system. I worked in the hse for about a decade over a 20 year period (with 7 year break as. In general, a pension buyback works this way:

A full basic state pension is worth £4,716 a year. To qualify for any state pension at all, you need 10. You may get gaps in your record if you do not pay national insurance or do not get national insurance credits.

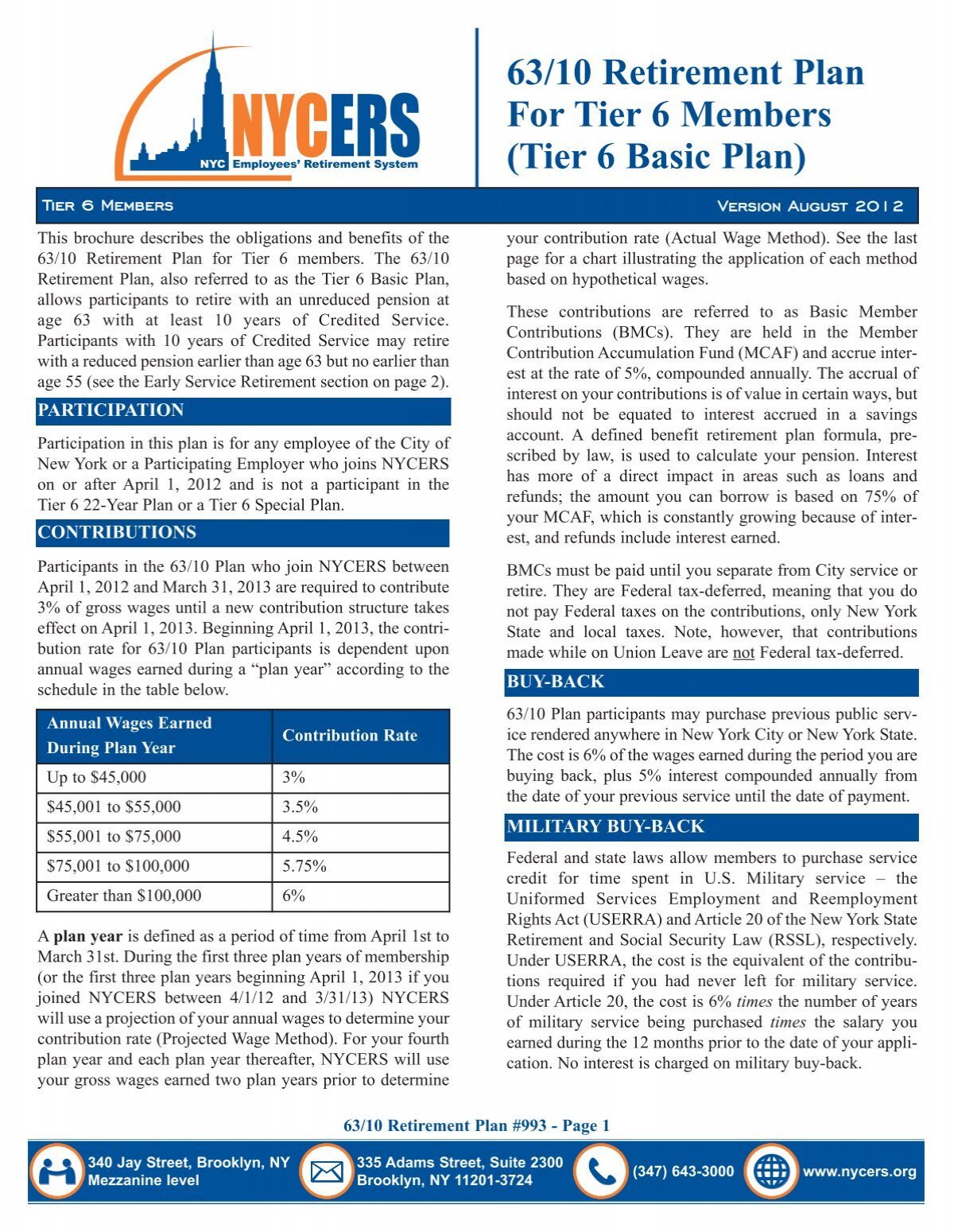

You may buy back your lost pension through monthly contributions providing that the contributions are more than £10 over a 12 month period. In order to buy back years in your hse pension you need a current active employee number. Purchase of notional service (pns) most civil and public servants who will have less than the maximum 40 years' service at retirement can make additional contributions to purchase.

How should i pay for my lost pension? The pension requires 25 years of service, and the question was whether buying the. The advice is to check with the pensions service whether buying back missing years in your ni record will increase your state.