Nice Tips About How To Be A Financial Advisor

Every financial advisor should be able to describe their ideal client.

How to be a financial advisor. First, always act in your client’s best interest. Before you speak to a financial advisor, decide which aspects of your financial life you need help with. If you make $2,500 per client, getting four new clients means $10,000 in revenue added to your business.

Ad the bryant cfp® program pass rate exceeds the national average, get started today. This should include workout sessions, healthy. Now that we know how the expert advisors work and how we can use it we’ll see the best expert advisors for 2022.

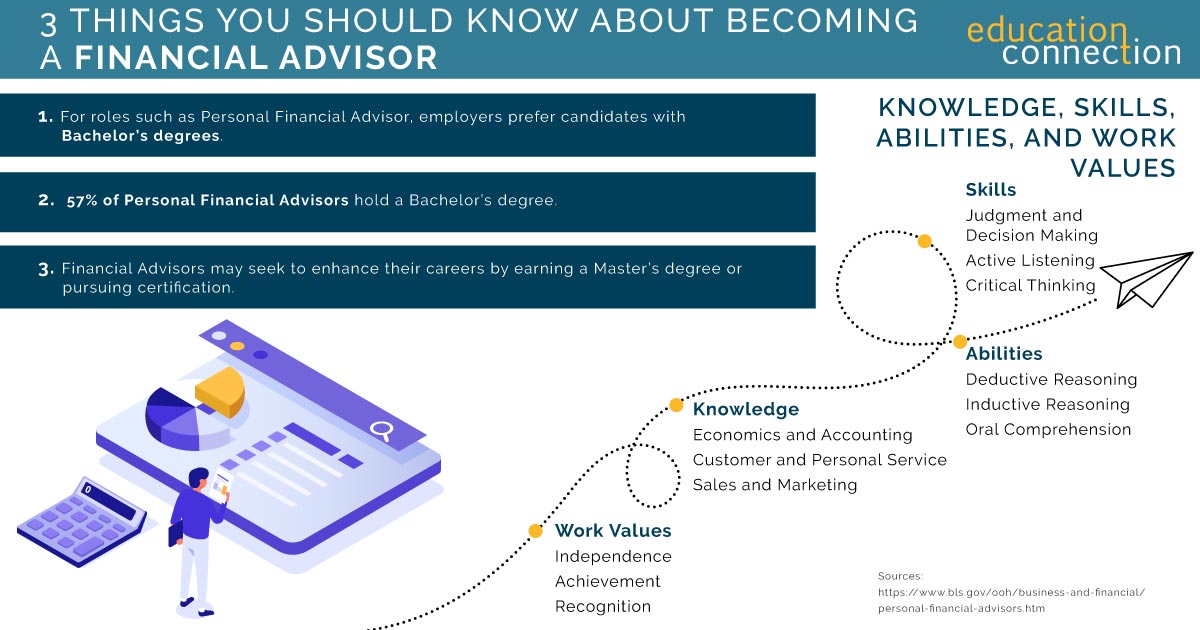

Always be honest and transparent with your clients. In order to be a successful financial advisor, you have to be accountable to your clients and therefore, hold yourself accountable for their success. Advisors do typically have some sort of financial educational background, like a degree in finance,.

To become a financial advisor, you must first earn your bachelor’s degree in a field related to finance, like business, accounting, statistics, etc. There’s hardly time to relax. 1) obtain a bachelor’s degree in finance, accounting, business, economics, or a related field.

Then, you should aim for an internship to. “if you want to be successful as a financial advisor, stay curious in all of your meetings and seek out their story,” medina says. Assuming a 50% “closing” ratio, you have four new clients.

Below is a list of five things you can start doing today to become a better financial advisor. Decide what part of your financial life you need help with. The easiest place to start vetting a financial advisor is finra’s brokercheck tool, which can tell you whether a person or firm is actually registered.

/financial-advisor-career-information-526017_final-9c1362c7706146ada8c9173002ddee69.png)